Table of Contents

- About QQQ - Holdings and Sector Allocations - Invesco QQQ | Invesco US

- QQQQ on Behance

- qqq letra logo diseño en blanco antecedentes. qqq creativo circulo ...

- QQQ: Almost Time For A Breather (NASDAQ:QQQ) | Seeking Alpha

- Methodology Changes for QQQ

- XQQ vs. QQQ: Should Canadians Buy CAD- or USD-Listed NASDAQ 100 ETFs ...

- QQQQ on Behance

- QQQQ | Meaning, Composition, Investing, Factors, and Role

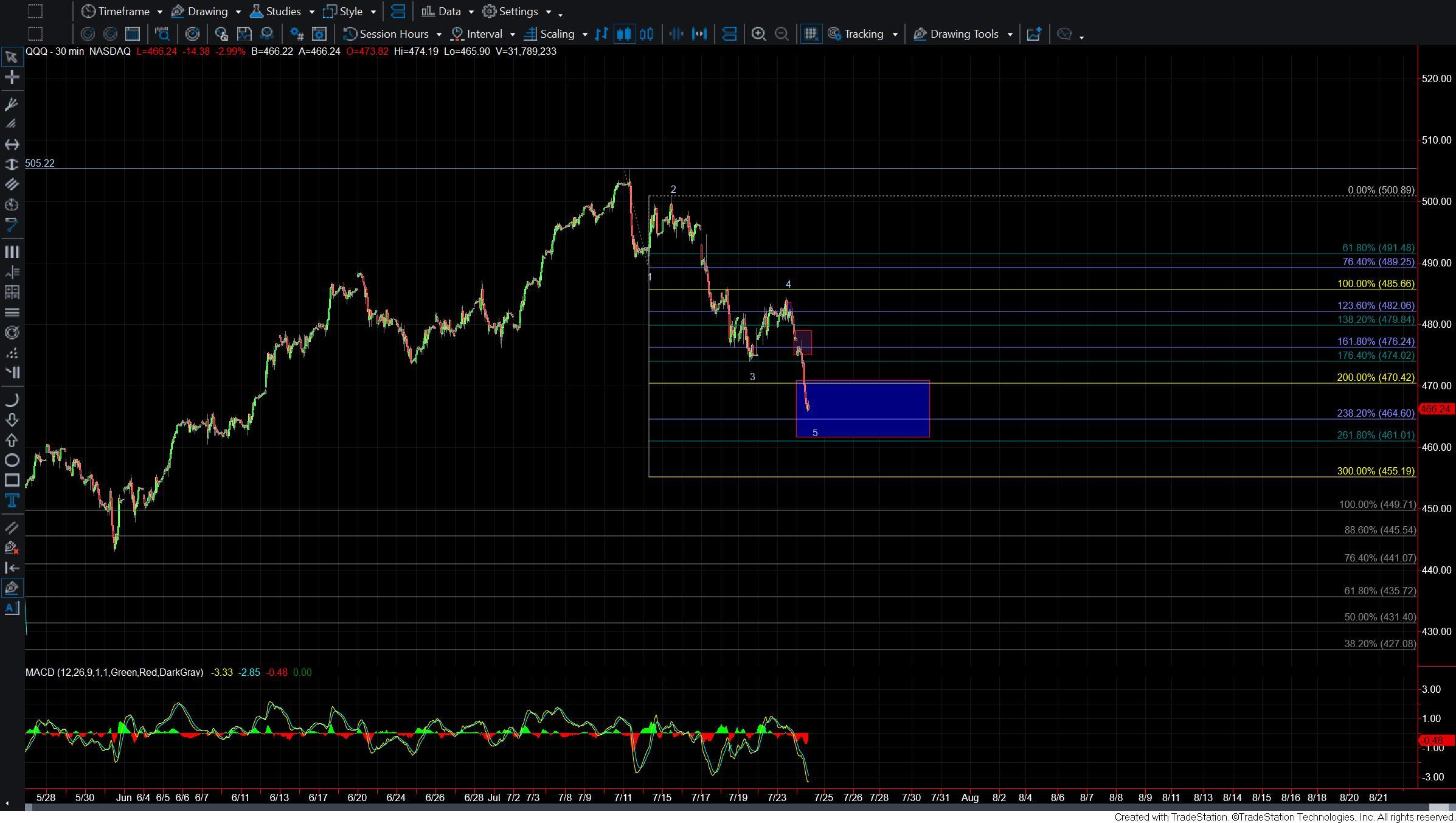

- Quite The Move In QQQ - ElliottWaveTrader

- Qqq Royalty Free Vector Image - VectorStock

What is the Invesco QQQ ETF?

Benefits of Investing in the Invesco QQQ ETF

Investment Strategy

The Invesco QQQ ETF can be a valuable addition to a diversified investment portfolio, particularly for those looking to tap into the growth potential of the US technology sector. Here are a few investment strategies to consider: Long-term investing: The Invesco QQQ ETF can be a good fit for long-term investors looking to ride out market fluctuations and capture the potential for long-term growth. Active trading: For more active traders, the Invesco QQQ ETF can be used to capitalize on short-term market movements and trends. Core-satellite investing: The Invesco QQQ ETF can be used as a core holding, with satellite investments in other asset classes or sectors to provide further diversification. The Invesco QQQ ETF is a popular and well-established ETF that offers investors a convenient and cost-effective way to tap into the growth potential of the US technology sector. With its diversified portfolio, low costs, and high liquidity, the Invesco QQQ ETF can be a valuable addition to a diversified investment portfolio. Whether you're a long-term investor or an active trader, the Invesco QQQ ETF is definitely worth considering.For more information about the Invesco QQQ ETF, including its current holdings, performance, and pricing information, visit the Invesco website. Remember to always do your own research and consult with a financial advisor before making any investment decisions.